Quarterly Market Update Q4 2024

Market Commentary

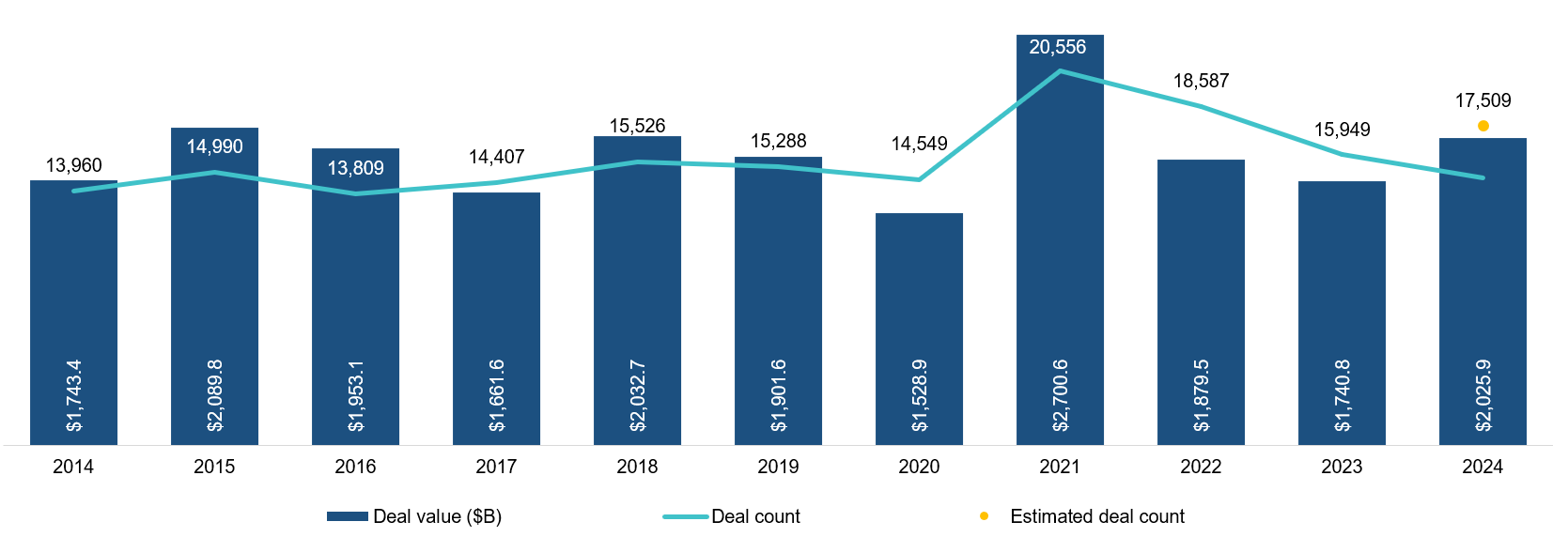

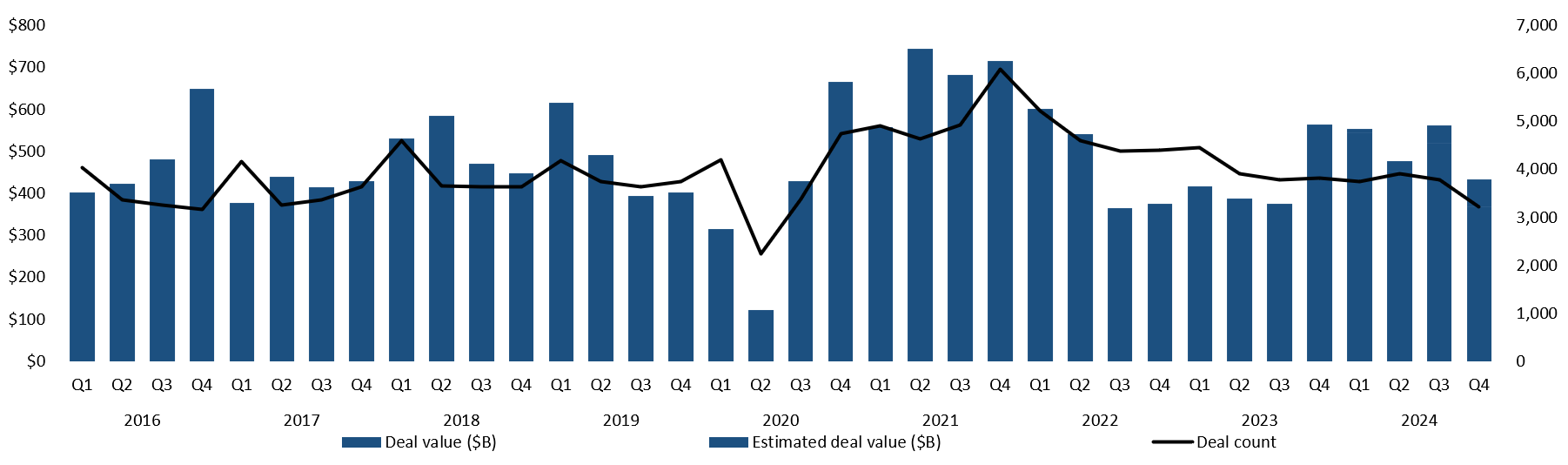

North American Market (All Sizes)

Global M&A activity achieved robust growth in 2024, fueled by more supportive macroeconomic conditions and stabilizing valuations. In North America, deal value surpassed $2 trillion across 17,509 deals, marking a 16.4% YoY increase in value and a 9.8% jump in count.

Quarterly deal activity in the North American market shows a return to robust deal activity throughout 2024, with each quarter in 2024 surpassing 2023 levels. Looking ahead to 2025, Pitchbook remains optimistic about further growth.

Market Commentary

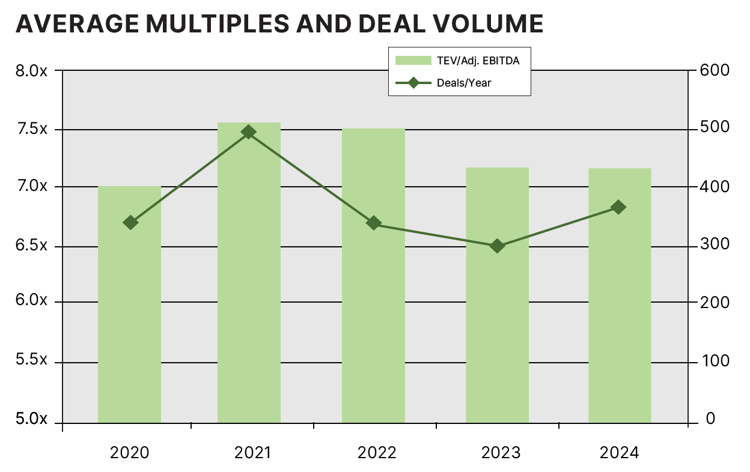

U.S. Private Equity ($10-500 Million)

GF Data is focused on the U.S. Private equity market, specifically transactions valued from $10 million to $500 million. For full-year 2024, GF Data tracked a 29% increase over 2023 in transactions closed, and also surpassing the 2022 deal count - making 2024 the second most active year since 2021.

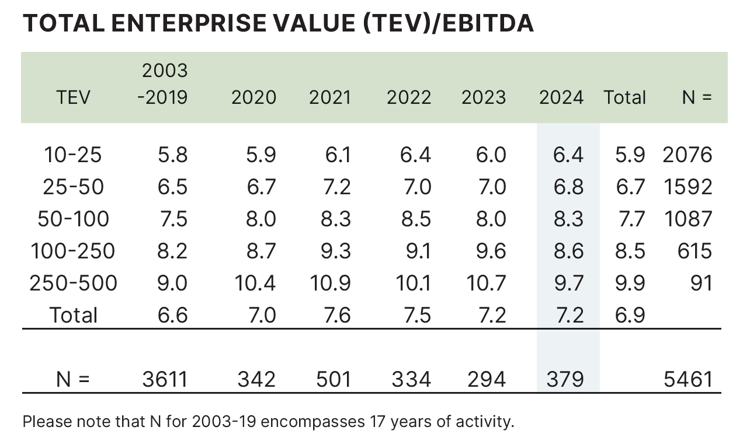

Valuations were steady or increasing across the deal sizes (TEV = Total Enterprise Value) for full year 2024, with transactions less than $25 million of enterprise value seeing an improvement in the average EBITDA multiple from 6.0x in 2023 to 6.4x in 2024.

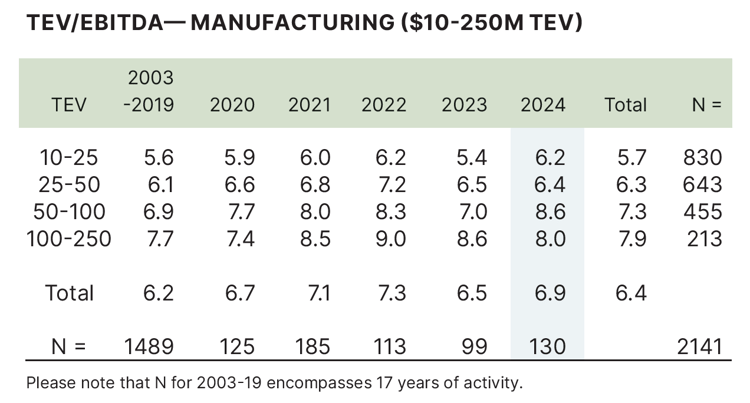

For manufacturing businesses between $10 and $250 million of enterprise value, multiples remain generally in the 6x to 8.5x range. As one would expect, the EBITDA multiple tends to increase with the size of the business. It is noted that multiple increased year over year from 2023 for every size category except for the $100 to $250 million range, where EBITDA multiples dropped slightly from 8.6x to 8.0x.

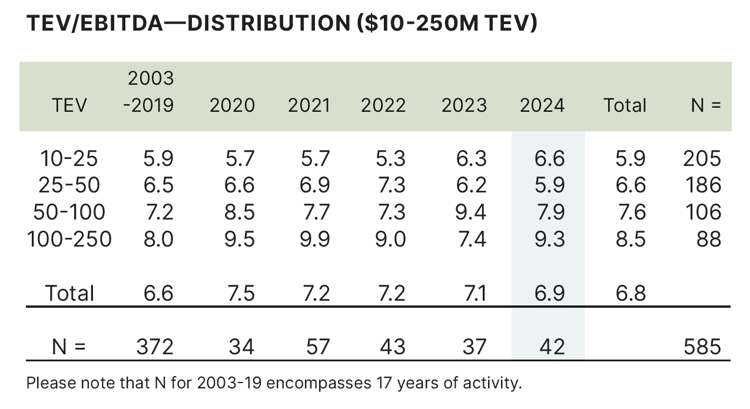

As a general rule, valuation multiples for distribution businesses tend to be higher than the multiples for manufacturing businesses, and that was demonstrated again for 2024. It should also be noted that there were significantly less distribution deals reported as compared with manufacturing businesses.

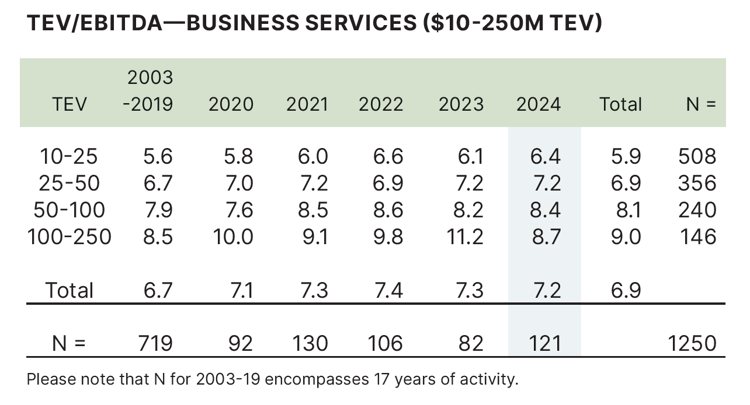

Finally, similar to distribution businesses, business services tends to command higher valuations than manufacturing businesses. This is especially noteworthy at valuations in excess of $50 million.

Regional Transactions of Interest

Announcement sources listed below.

True North only advised on transactions if explicitly noted.

December 1, 2024

PRIORITY HEALTH ANNOUNCES ITS COMPLETED AQUISITION OF PHPNI

FORT WAYNE, IN - Priority Health, a Michigan-based health plan serving more than 1.3 million members, announced the acquisition of control of Physicians Health Plan of Northern Indiana (PHPNI). Established in 1983, PHPNI is headquartered in Fort Wayne, Indiana, and is a leading commercial health plan offering employer sponsored benefits and third party administration to more than 50,000 members primarily across Indiana and Ohio.

Source: PHPNI.com

November 22, 2024

DO IT BEST SUCESSFULLY COMPLETES PURCHASE OF TRUE VALUE

FORT WAYNE, IN – Do it Best announced the successful acquisition of True Value, a long-time competitor with a legacy brand that benefits both organizations. This monumental transaction represents a transformative milestone for Do it Best, True Value, and the entire independent hardware industry. The acquisition brings significant assets to Do it Best, including inventory, brand rights, and paint manufacturing facilities. The transaction creates the world’s largest network of independent home improvement stores.

Source: DoItBestOnline.com

October 31, 2024

KSM (KATZ, SAPPER & MILLER) EXPANDS WITH ADDITION OF SGKK

INDIANAPOLIS, IN – KSM, a leading advisory, tax, and audit firm, announced its expansion in New York City with the addition of Shanholt Glassman Klein Kramer & Co. (SGKK), a CPA firm with a focus on the real estate industry and one of the 250 largest CPA firms in the U.S. This transaction substantially increases KSM’s New York presence and marks KSM’s second major acquisition of 2024. Founded in 1931, SGKK has grown to become one of the 250 largest CPA firms in the U.S., providing accounting, tax, and consulting services to local, national, and global businesses.

Source: KSMCPA.com