Q1 2025 Quarterly Market Update

True North Market Commentary

The merger and acquisition markets started 2025 in very strong fashion with all segments – Global, North American, and Private Equity – showing quarterly growth from Q4 2024 and year over year growth from Q1 2024. However, mid-quarter the markets slowed considerably due to concern over tariffs and recession risks.

Despite the overall market slowdown in the second half of Q1, the equity and debt markets have significant capacity for quality companies that do not have significant exposure to tariff impacts. Service companies, distribution companies with primarily U.S. sourcing, or manufacturing companies with predominately U.S. suppliers will all receive a very favorable market acceptance. As evidenced throughout Q1, valuations have improved, perhaps showing the scarcity value of quality companies which do not have a significant tariff exposure.

Strategic buyers, private equity, and family offices have communicated to us their continued strong interest in any new opportunities we have to present to them.

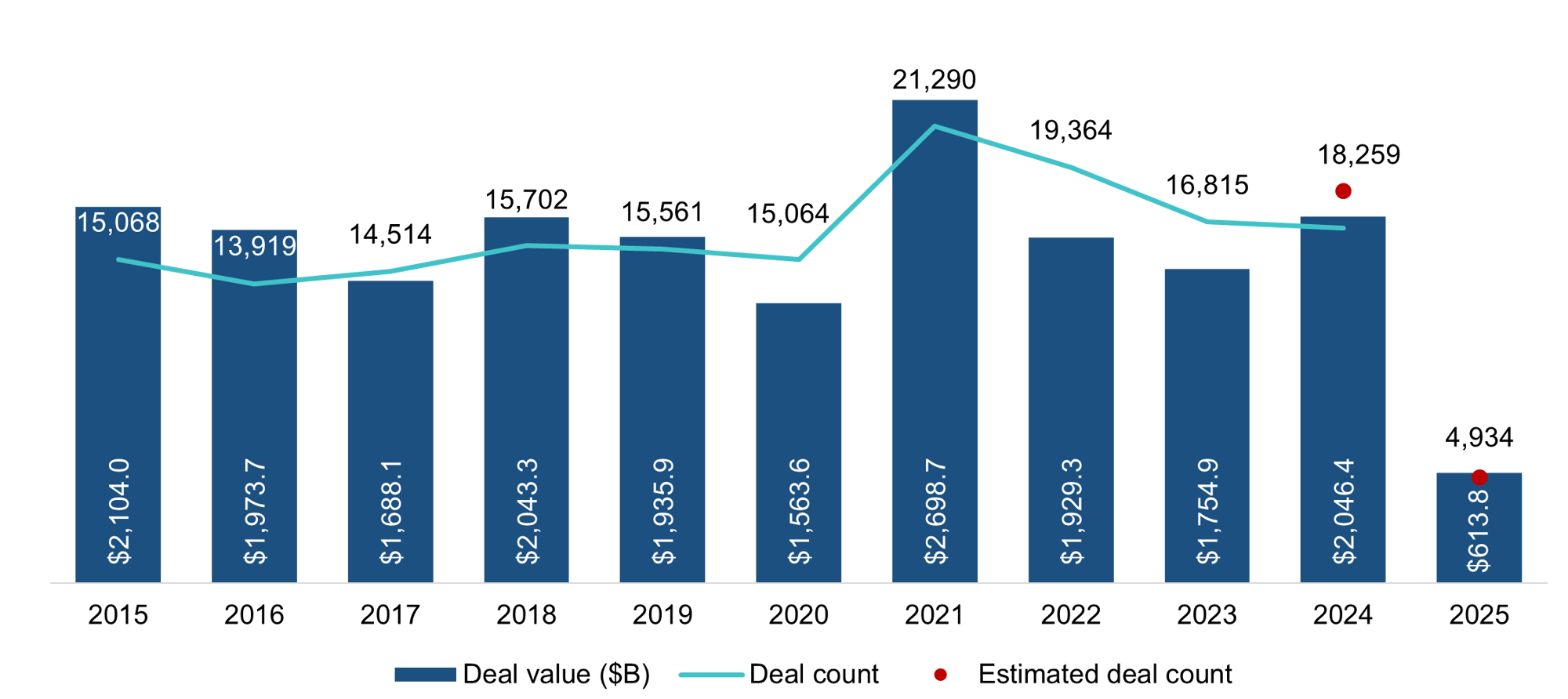

North American Market (All Sizes)

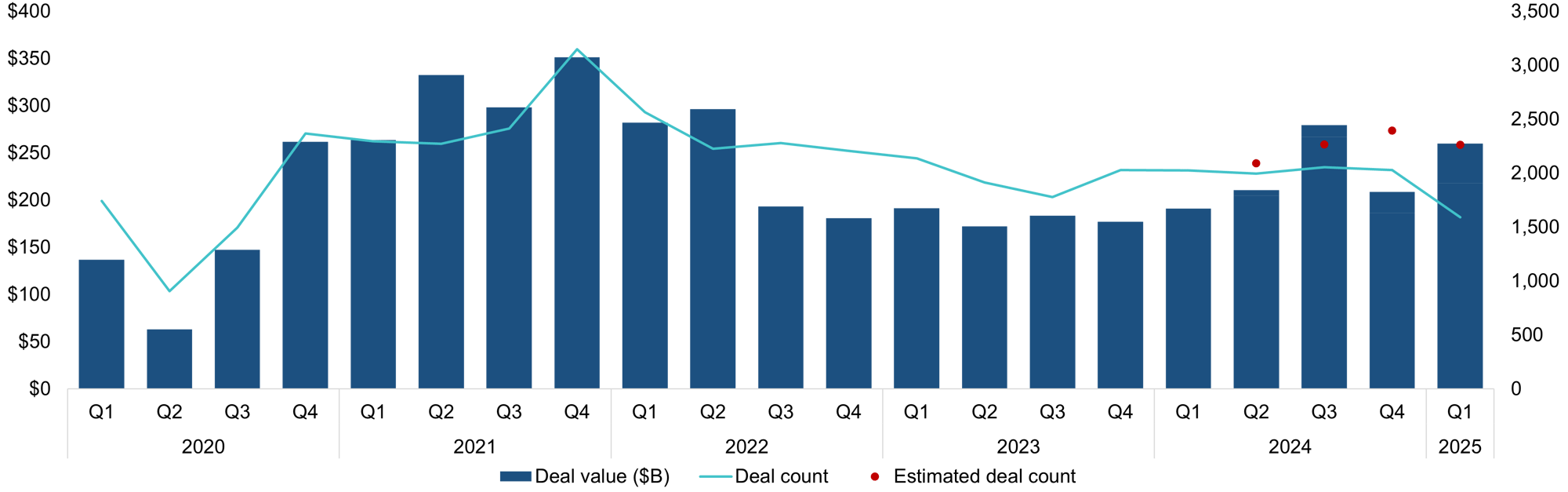

Global M&A activity achieved robust growth in Q1 2025, with North America dominating the top 10 leaderboard based on deal size, securing 80% of deals. As shown in the chart below Q1 2025 North American M&A activity advanced in strong fashion, reaching a total deal value of $613.8 billion across 4,934 announced or closed transactions. Driven by an influx of large-scale transactions, total value surged by 28.3% as compared with Q4 of 2024, but up 10.3% as compared to Q1 of 2024. Deal volume saw a modest decline of 1.9% since the last quarter, but up almost 20% since Q1 of 2024. Market sentiment started optimistically, fueled by expectations of continued growth; however, the landscape shifted dramatically mid-quarter, marked by heightened caution amid intensifying concerns over tariffs and recession risks. Looking ahead, Q1 could represent the peak of M&A activity for the year if economic uncertainties persist or deepen. Conversely, stabilization in the macroeconomic environment could catalyze further significant dealmaking, sustaining the growth trajectory observed early in the year.

U.S. Private Equity

PE dealmaking entered 2025 on a strong note. With ample credit availability and a substantial reservoir of dry powder, dealmakers stayed active, building on momentum from last year. However, optimism regarding 2025 has dampened as the uncertainty of tariffs, a slowdown in government spending, and recession risks may slow activity in those sectors with exposure to these specific risks.

Valuation Metrics

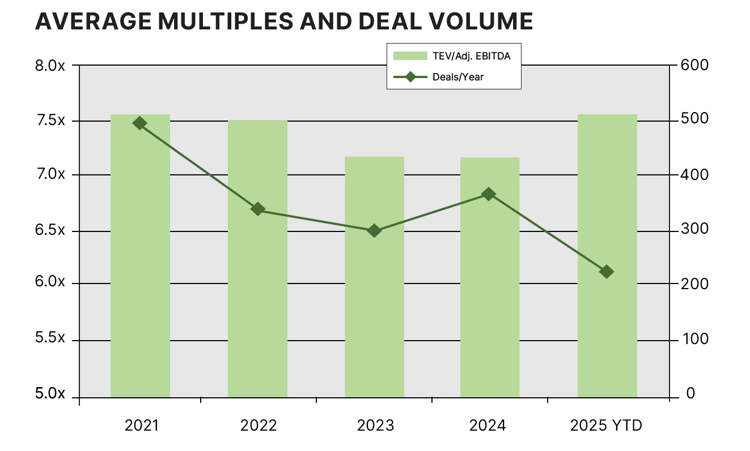

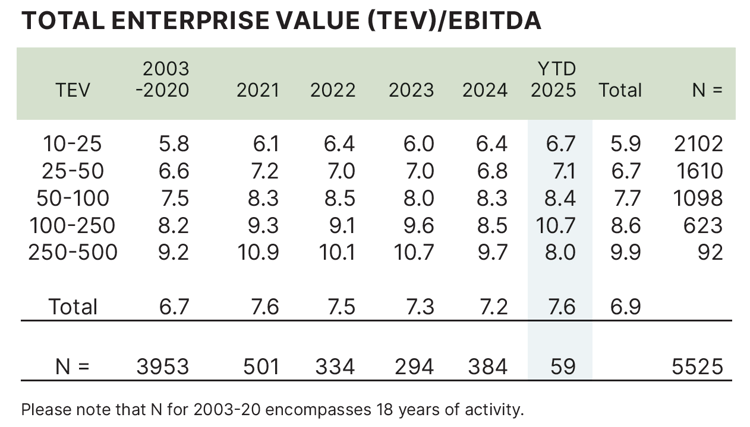

U.S. Private Equity Reported Transactions ($10-500 Million)

GF Data is focused on the U.S. Private Equity market, specifically reported transactions valued from $10 million to $500 million. For Q1 of 2025, GF Data reported a drop of nearly 40% from the prior quarter, indicating an adverse impact of political and economic uncertainty on the lower end of the middle market. Despite the lower deal count, average purchase price multiples rose to 7.6x TTM Adjusted EBITDA, the highest quarterly average since mid-2022, compared to 7.3x in the fourth quarter.

Valuations were steady or increasing across the deal sizes (TEV = Total Enterprise Value) for Q1 of 2025, with transactions less than $25 million of enterprise value seeing an improvement in the average EBITDA multiple from 6.4x in 2024 to 6.7x in YTD 2025.

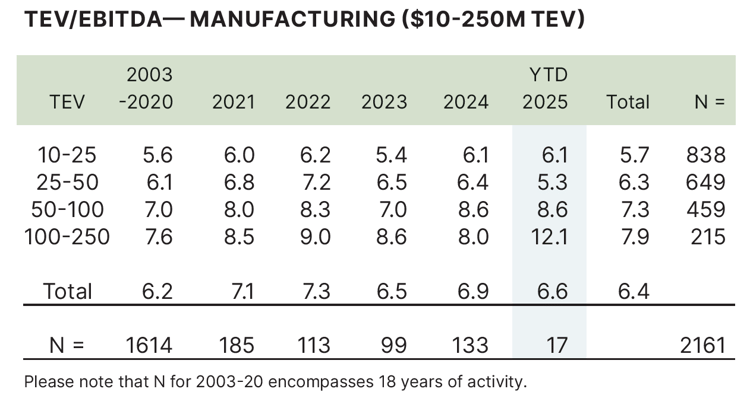

For manufacturing businesses between $10 and $250 million of enterprise value, multiples remained steady in the less than $25 million TEV segment. Multiples dropped in the $25-50 million TEV range and increased significantly in the $100 million range, with both segments likely impacted by the smaller sample size.

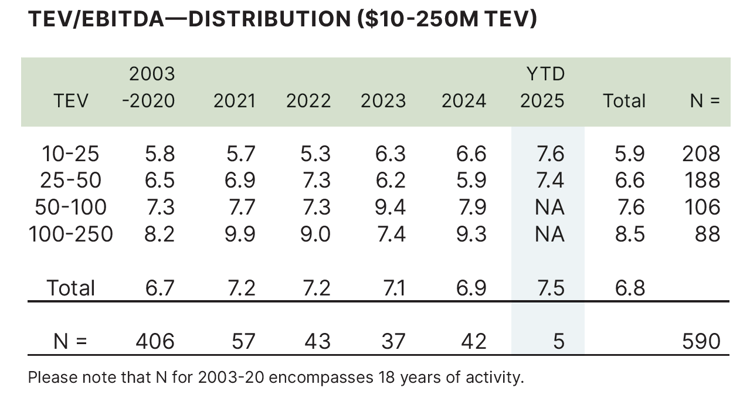

Valuation multiples for distribution businesses increased sharply in Q1 of 2025, showing the favorability of this sector given the global economic uncertainty. It should also be noted that there were significantly less distribution deals reported as compared with manufacturing businesses.

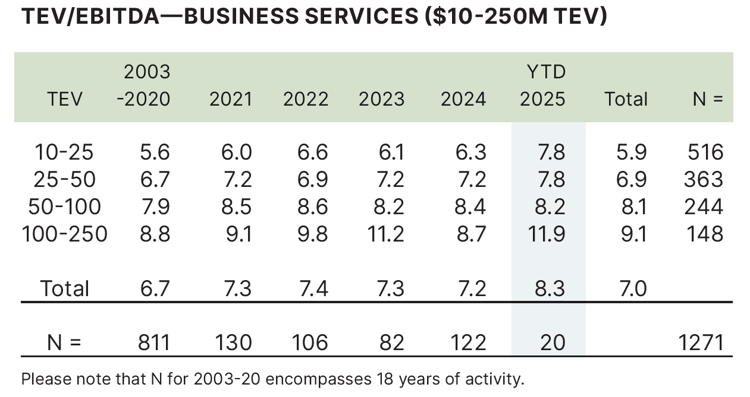

Finally, similar to distribution businesses, business services tend to command higher valuations than manufacturing businesses. Valuations rose sharply in the service business sector, likely indicating the isolation from tariff uncertainty.

December 13, 2024

THE PRINCIPALS OF TRUE NORTH ADVISE UNITED ORTHO IN SALE

United Ortho sold it business to Promus Equity. United Ortho manufactures and distributes orthopedic bracing to medical professionals and their patients throughout the United States and internationally.

The Principals of True North advised United Ortho in this transaction and acted in their capacity as registered investment banking agents of Burch & Company, Inc., member FINRA/SIPC. Burch and True North are not affiliated entities.

Source: True North Strategic Advisors

March 19, 2025

FORWARD ACQUIRES BAR KEEPERS FRIEND

INDIANAPOLIS & GREENWICH, Conn.--(BUSINESS WIRE)--Forward Consumer Partners, a private investment firm focused on branded consumer products, announced that it has acquired SerVaas Laboratories, Inc., makers of Bar Keepers Friend, a trusted brand of highly effective household cleaning products.

Source: Business Wire, Inc.

January 21, 2025

TOP 25 ACCOUNTING AND ADVISORY FIRM CRI ANOUNCES ACQUISITION OF CAPINCROUSE LLP

Enterprise, AL, and Indianapolis, IN – Top 25 accounting and advisory firm CRI announces its acquisition of top 125 firm, CapinCrouse LLP, effective January 17, 2025. This move marks the largest merger deal in CRI's firm history and comes after the firm's first strategic growth investment from Centerbridge Partners and Bessemer Venture Partners in November 2024.

Source: Carr, Riggs & Ingram

November 19, 2024

BW FUSION, BIODYNE, AND AGRONOMY 365 JOIN TO REVOLUTIONIZE AGRICULTRUAL INDUSTRY,

SUPPORTED BY BAIN CAPITAL DOUBLE IMPACT

FORT WAYNE, Ind. & FONDA, Iowa--(BUSINESS WIRE)--BW Fusion, an innovator in agricultural crop and soil nutrition; Biodyne, an environmental microbiology company; and Agronomy 365, a tech-enabled crop analytics and management program; announced their merging to create an integrated platform under BW Fusion. The combined company will offer growers more effective and sustainable biologicals at every stage of the crop nutrition cycle. The transaction formalized a previous strategic alliance between the three companies and will accelerate product innovations and enhance grower support. Financial support for the transaction was provided by Bain Capital Double Impact, the impact investing arm of Bain Capital.

Source: Business Wire, Inc.