Q2 2025 Quarterly Market Update

True North Market Commentary

The merger and acquisition markets in Q2 2025 reflected both selectivity and resilience. Activity levels remained healthy, but buyers have become more selective, focusing their attention on companies that demonstrate scale, stability, and strong fundamentals. Companies experiencing adverse tariff impacts and/or revenue disruptions due to overall market uncertainty are not accessing the capital markets, thus slowing down supply.

Across industries, we continue to see a clear preference for businesses with domestic supply chains and recurring revenue models. Service providers and distribution companies are drawing steady interest, while larger manufacturing and industrial firms with reliable U.S. sourcing are commanding a premium. Investors are showing discipline, but when a business checks the right boxes, the market response has been strong.

We also note that valuations have begun to stabilize. While no longer at the levels seen in 2021 and 2022, quality companies are still finding favorable terms. For many buyers, the scarcity of strong opportunities outweighs the caution created by tariffs and broader economic uncertainty.

M&A Activity Holds Firm Amid Exit Slowdown

The M&A market showed its staying power in Q2 2025. While U.S. private equity dealmakers continue to navigate interest rates, inflation, and policy noise, overall activity held steady with signs of strength in core sectors. It is a selective market, but not a frozen one.

Key Highlights

Deal Activity Remains Consistent

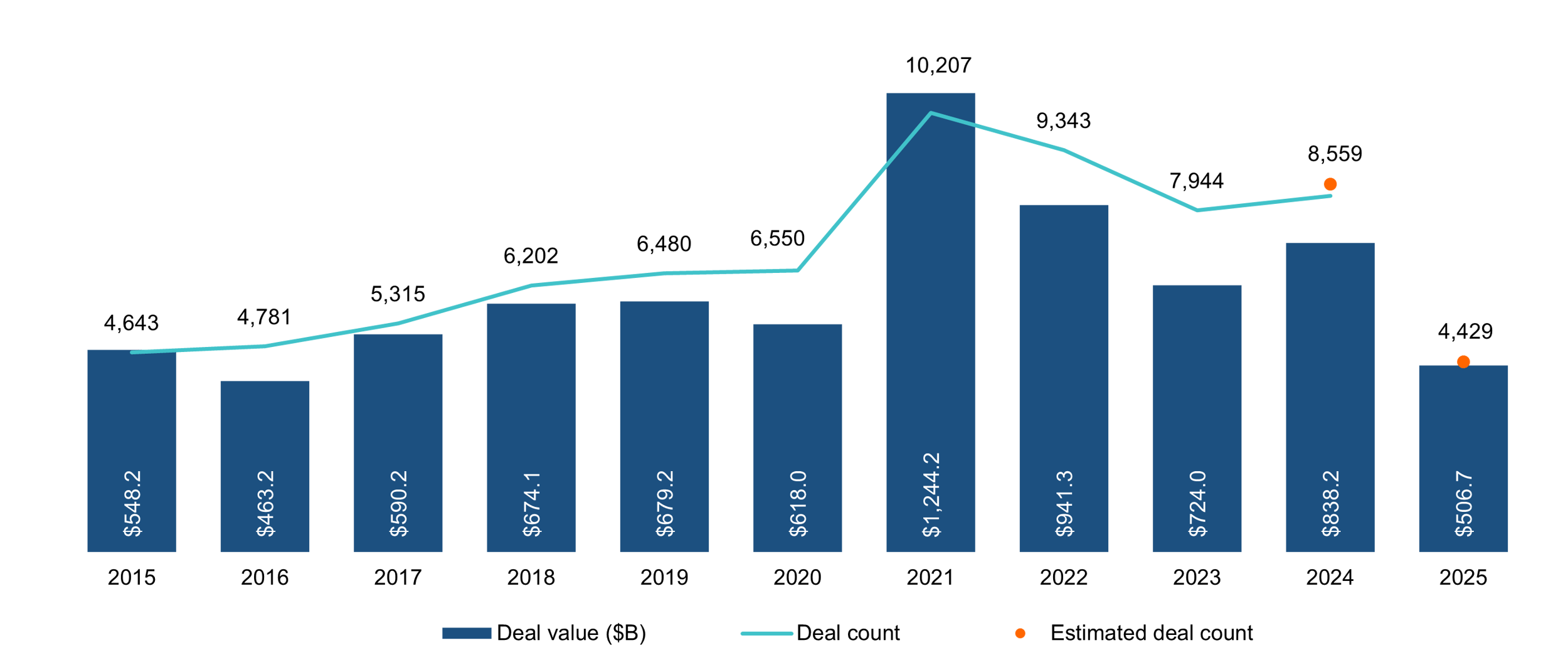

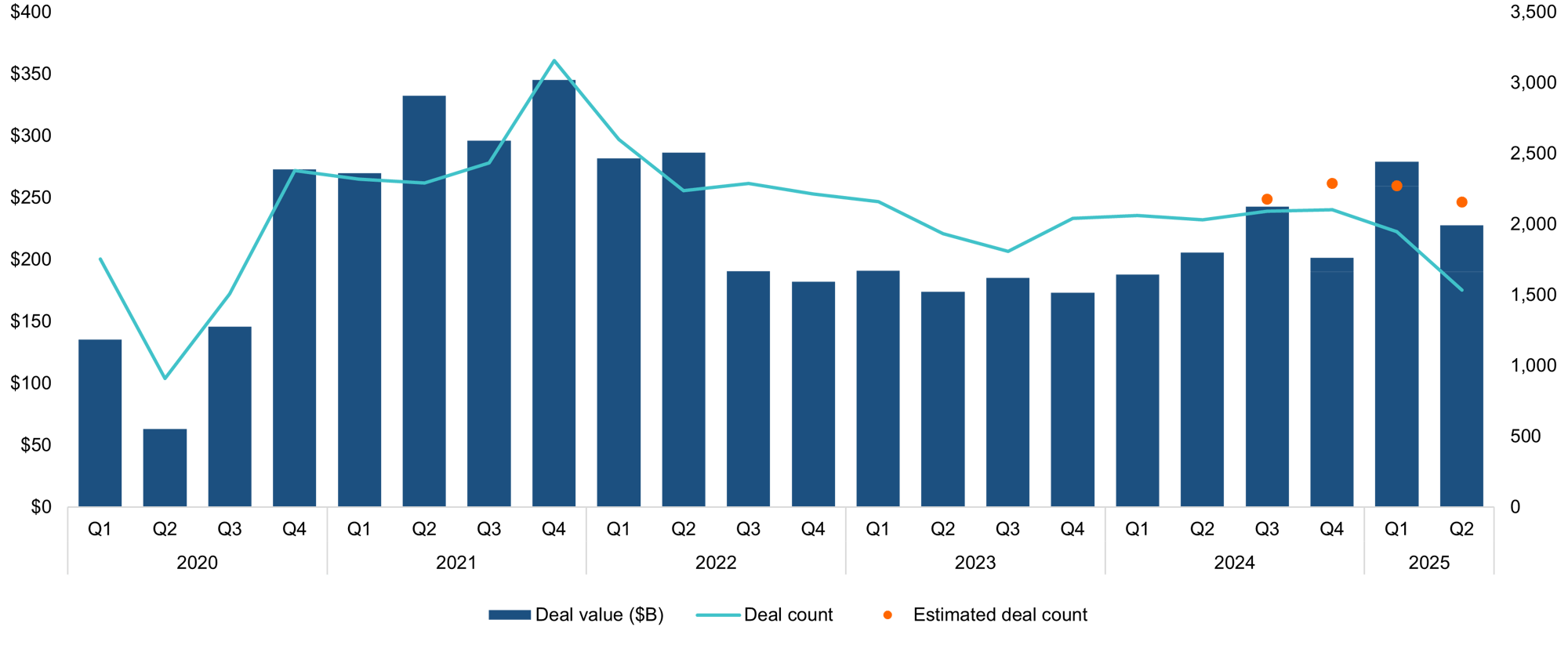

U.S. private equity sponsors closed 2,158 deals in Q2, a modest 5% dip from Q1. Despite the volume holding strong, total deal value fell to $227.7 billion, down 18% from last quarter, but still tracking 11% ahead of the same period last year. Notably, year-to-date deal value sits 29% higher than 1H 2024, reflecting a handful of larger transactions pushing up the total.

Valuations Are Firming Up

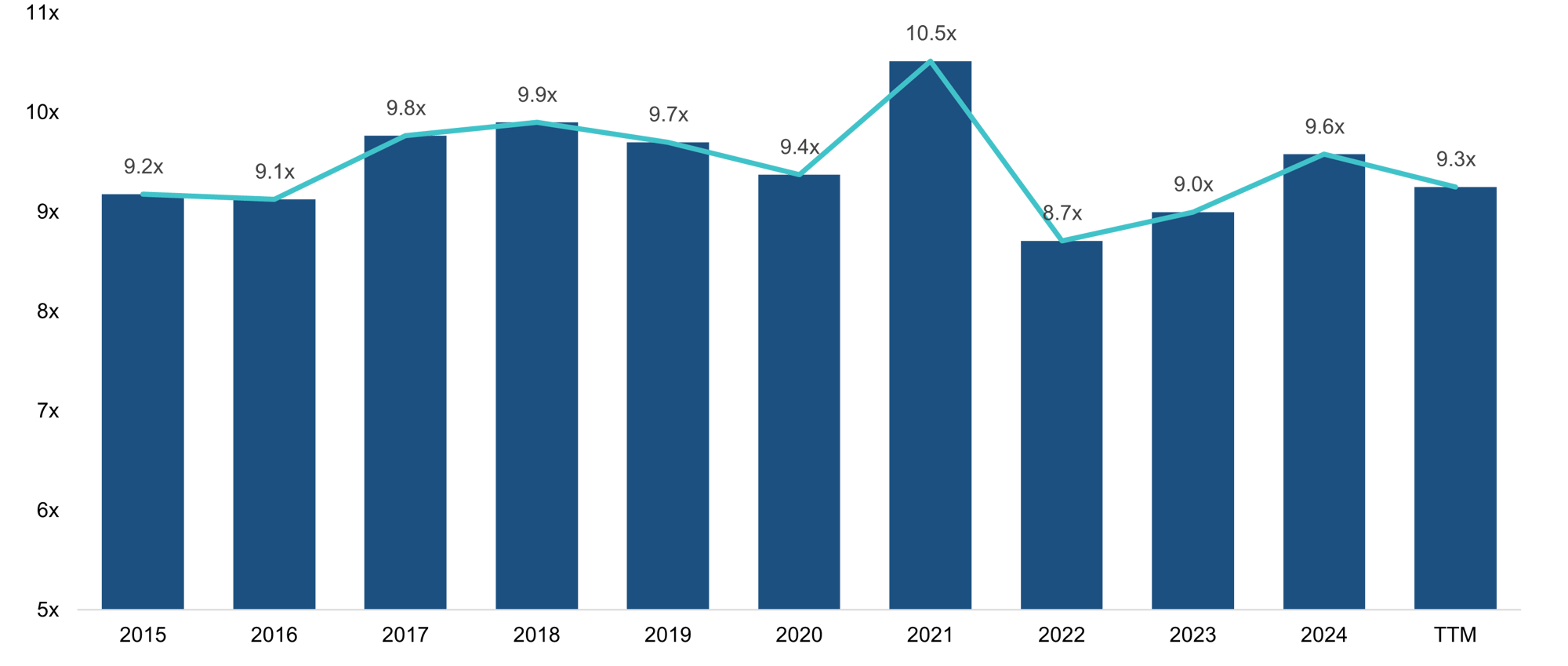

Global M&A multiples continued a gradual climb, with overall enterprise value to EBITDA ratios holding around 9.3x. Private equity buyouts pushed higher, with median multiples landing at 11.7x. While these are not 2021 highs, they indicate solid pricing for quality companies.

Exits Cooled Meaningfully

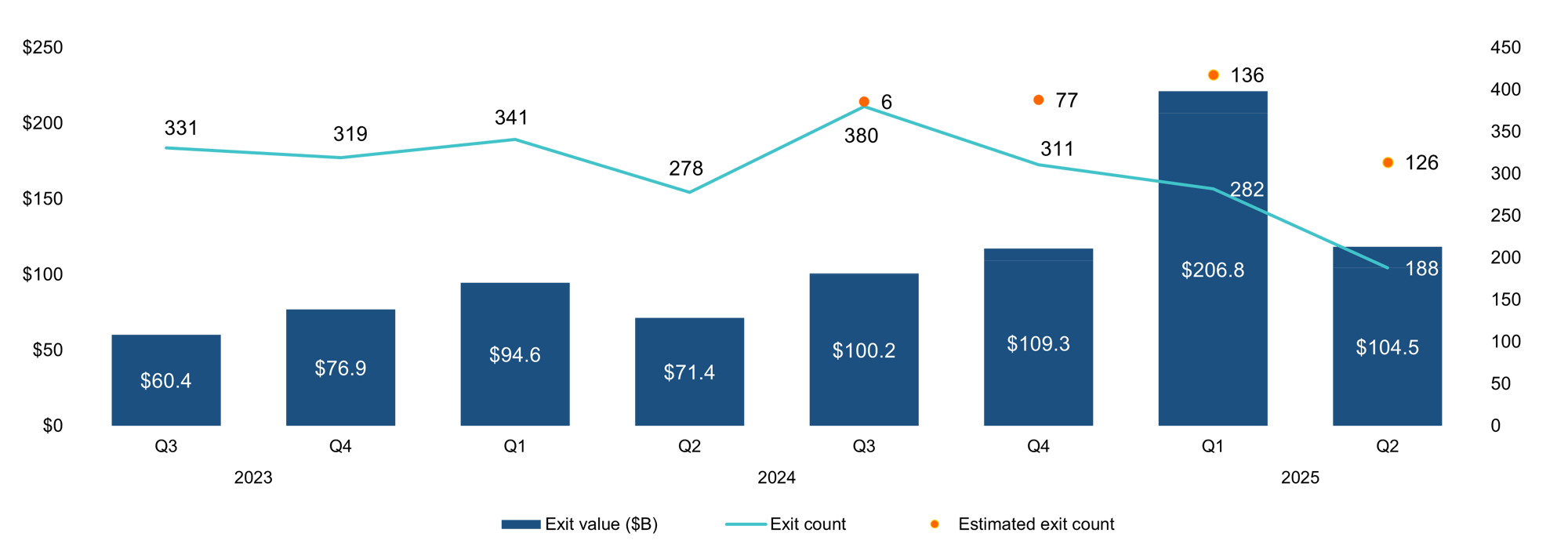

The exit market pulled back in Q2, with 314 transactions totaling $104.5 billion, a 49% decline in value from Q1. That said, exit value is still up more than 65% from last year excluding IPOs.

What It Means For Business Owners

For privately held businesses considering M&A, the environment favors those that are well-positioned. Strategic buyers and PE firms continue to be active but are focusing on resilient sectors and companies with pricing power, scalability, and clear growth narratives. Supply chain clarity, input cost stabilization, and balance sheet strength are major differentiators.

Looking Ahead

Expect the second half of 2025 to bring continued deal flow, but with more selectivity. Companies that can demonstrate defensibility, strong margins, or platform potential will remain in high demand. Carve-outs and add-on strategies will continue to dominate as firms seek scale and cost efficiency amid macro ambiguity.

Valuation Metrics

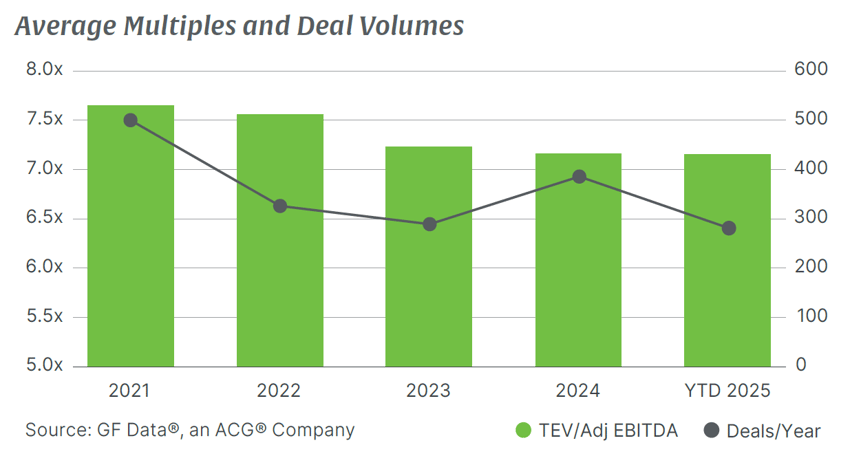

U.S. Private Equity Reported Transactions ($10-500 Million)

GF Data is focused on the U.S. Private Equity market, specifically reported transactions valued from $10 million to $500 million. In the first half of 2025, the GF Data report cited 121 buyout deals, with an average multiple of 7.2x, slightly lower than the 7.5x recorded through Q1, yet on par with the full-year 2024 average of 7.1x, signaling a pullback from the early-year rebound.

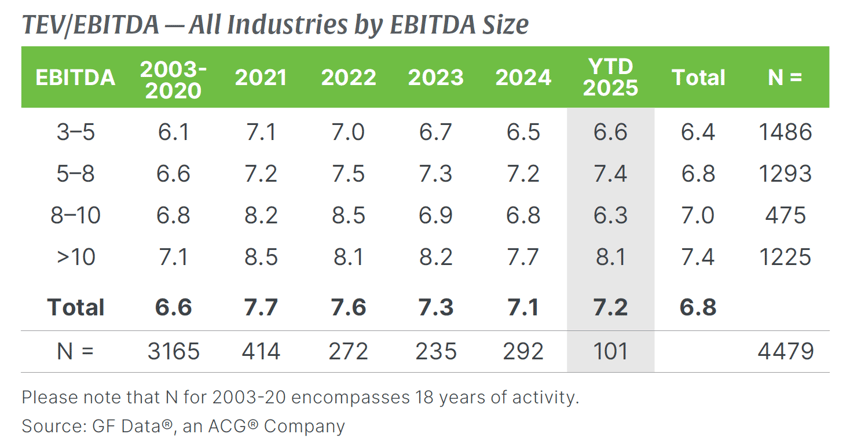

In looking at more detailed transaction data by size, middle-market valuations are holding above long-term norms but remain below the peak levels of 2021 and 2022. In the first half of 2025, average multiples came in at 7.2x across add deal sizes, up slightly from 2024’s 7.1x. Smaller companies in the $3–5M EBITDA range traded at 6.6x, reflecting more pricing discipline, while larger businesses above $10M EBITDA commanded a premium at 8.1x, underscoring investor preference for scale and stability. Overall, the data highlights a selective market where scale continues to draw stronger multiples, while smaller and mid-tier companies face greater valuation pressure.

Manufacturing sector valuations fell in H1 2025, with the mean EBITDA multiple slipping to approximately 6.5x, a modest retreat from 7.0x in 2024 and 6.5x in 2023. Smaller manufacturing deals in the $10–25M TEV range averaged 5.8x, consistent with long-term norms but reflecting a limited buyer appetite for smaller companies. The largest transactions continue to attract a premium at 9.9x, underscoring that scale drives stronger pricing power and investor demand. Taken together, the data shows that while manufacturing valuations have pulled back from post-COVID highs, larger, higher-quality businesses still trade at strong multiples, while smaller deals are facing more pricing pressure.

.png?width=850&height=450&name=Q2%202025%20GF%20Data%20TEV-EBITDA%20Manufacturing%20($10M-$250M%20TEV).png)

Distribution businesses are trading at an overall 7.0x multiple YTD 2025, slightly above 2024’s 6.9x but still below the stronger 2021–2022 levels (7.1x–7.2x). Smaller deals in the $10–25M range averaged 6.7x, consistent with long-term norms and showing relative resilience. The $25–50M enterprise value tier came in at 6.6x, down from a 2022 high of 7.6x, while the $50–100M tier averaged 7.3x, holding near historical averages. The largest transactions continued to command a premium at 9.7x, reflecting a stronger investor appetite for scale and higher-quality assets. While distribution valuations have moderated since their peak, larger platform-sized assets are still highly valued, while smaller and mid-tier deals are being priced closer to historical norms.

.png?width=850&height=446&name=Q2%202025%20GF%20Data%20TEV-EBITDA%20Distribution%20($10M-$250M%20TEV).png)

Finally, in 2025 YTD, the business services average multiple is 7.5x, above the 2024 level of 7.2x and significantly higher than the long-term average of 6.7x. Smaller deals in the $10–25M range averaged 6.9x, while mid-tier deals held at 7.6x, both reflecting resilience relative to broader market softening. The $50–100M tier continues to perform well at 8.1x, while the largest transactions are trading at a premium of 10.3x. Business services valuations are holding firm near post-COVID highs, with the sector showing greater pricing strength than manufacturing or distribution, especially at the larger end of the market.

.png?width=850&height=455&name=Q2%202025%20GF%20Data%20TEV-EBITDA%20Business%20Services%20($10M-$250M%20TEV).png)

May 30, 2025

THE PRINCIPALS OF TRUE NORTH ADVISE LIFT-A-LOFT IN SALE

Holleway Capital Partners has made a strategic investment in Lift-A-Loft, LLC. Headquartered in Muncie, IN, Lift-A-Loft is a leading provider of custom engineered aerial work platforms to the transportation, logistics, and industrial markets. Holleway Capital Partners is a St. Louis-based private equity firm providing financing to businesses whose owners want to sell their companies and transition to retirement, aligning with management teams to continue to operate and grow the businesses.

The Principals of True North, acting in their capacity as registered agents of Burch & Company, Inc. (“Burch”), were the lead strategic and financial advisors to Lift-A-Loft in this transaction. In order to assist True North with securities related transactions, its principals are registered investment banking agents of Burch & Company, Inc., member FINRA/SIPC. Burch and True North are not affiliated entities.

Source: True North Strategic Advisors

May 15, 2025

THE WALDINGER CORPORATION ACQUIRES PROJECT DESIGN AND PIPING, INC.

DES MOINES, Iowa -- The Waldinger Corporation announced it has acquired Project Design and Piping, Inc., a leading mechanical contractor in Fort Wayne, Indiana. Founded in 1986 by Kuno Mirwaldt and his son, Curtis, Project Design and Piping performs mechanical and plumbing contracting work for clients in the commercial, industrial, and institutional markets throughout Northeast Indiana. Founded in 1906 and headquartered in Des Moines, Iowa, The Waldinger Corporation is a premier full-service mechanical, electrical and sheet metal contractor.

Source: The Waldinger Corporation

June 11, 2025

FAIRWAY ACQUIRES ASSETS OF HALLMARK HOME MORTGAGE

MADISON, WI -- Fairway Independent Mortgage Corporation announced that it has agreed in principle to an asset sale with Hallmark Home Mortgage. Significant assets of Indiana-based Hallmark, licensed in 20 states, will become part of Fairway, the nation's second-largest retail mortgage lender. Hallmark Home Mortgage, Powered by Fairway, will be a new division of Fairway.

June 25, 2025

ELTON MANUFACTURING EXPANDS INTO THE US WITH ACQUISITION OF DECATUR PLASTIC PRODUCTS

MISSISSAUGA, Ontario--(BUSINESS WIRE)--Elton Manufacturing, a leading supplier of weatherstripping and windows for garage doors and entry doors in North America, announced its acquisition of the assets of Decatur Plastic Products (DPP) in North Vernon, Indiana. Elton will uphold its brand identity by operating in the US as “Elton USA”. Since its foundation in 1983, Decatur Plastic Products (DPP) has become a well-established manufacturing company specializing in injection molding, fiber flock coating, assembly work, and tool building to the automotive industry. They provide high-quality custom injection molded plastic parts and components.

Source: Business Wire, Inc.